- Home

- EventsEvents

- Product Launches

- CategoriesCategories

- Advertise

- Opinion

The South Korean market for ice cream will continue to shrink in the coming years in line with the contracting population size. The sporadic outbreaks of new COVID-19 variants, and the intensifying price war among ice cream makers, particularly in light of the rising cost of living crisis, will also constrain value sales in the immediate future. As a result, the South Korean ice cream market is projected to decline to KRW1,047.1 million ($929.9 million) by 2026, registering a negative compound annual growth rate (CAGR) of 5.8% over 2021–26, says GlobalData, a data and analytics company.

GlobalData’s report, South Korea Ice cream - Market Assessment and Forecasts to 2026, reveals that the market growth will be primarily driven by the impulse ice cream single-serve category, followed by the take-home and bulk ice cream category.

Suneera Joseph, consumer analyst, GlobalData, says, “Consumers stocked up their refrigerators with large bulk ice cream packs to indulge themselves during the protracted COVID-19 lockdowns and quarantines in 2020. Manufacturers also rolled out discounts and special offers to boost volumes at the cost of value sales. However, this stockpiling behavior dissipated in 2021 and 2022 as the COVID-19 restrictions on public outdoor movement were relaxed.

“Both, on-the-go and on-premise consumption of ice creams resumed with the reopening of food service venues and the increasing number of consumers returning to their educational institutions and workplaces. As a result, smaller pack sizes gained traction in 2022. Going forward, the contracting average household size will drive the demand for smaller packs. However, the surge in new COVID-19 cases due to new mutant variants in the second half of 2022 is expected to sap the consumption of ice creams in 2023.”

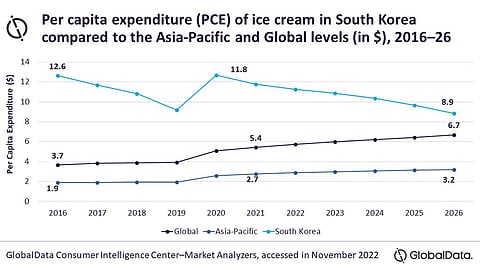

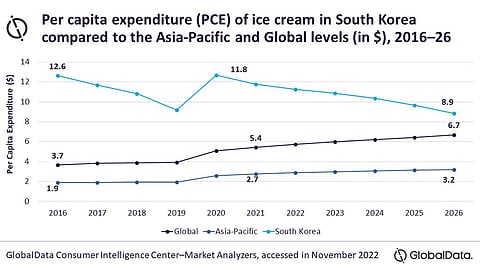

Moreover, the shrinking and rapidly aging population led to a decline in overall consumer spending on ice creams, and this trend is expected to prevail over the forecast period. As a result, the per capita expenditure (PCE) on ice cream in South Korea decreased from $12.6 in 2016 to $11.8 in 2021. However, this surpassed the regional average PCE of $2.7 and the global average of 5.4 dollars South Korea’s PCE on ice cream will further decline to 8.9 dollars by 2026.

Hypermarkets and supermarkets were the leading distribution channel in the South Korean ice cream market in 2021, followed by convenience stores and food and drinks specialists. Binggrae, Lotte, and Inspire Brands were the top three companies in value terms in 2021, while Pollapo and Natuur were the leading brands.

Joseph concludes, “Ice cream manufacturers in South Korea are stepping up product innovation to stimulate consumption, developing novel flavors customized for local palates, and rolling out better-for-you variants with less sugar, fat, and calories. The introduction of fortified and functional ice creams targeting adults, particularly the sizable elderly populace of 65+ years, will also support sales to some extent. Despite such efforts of manufacturers to premium the ice cream sector, premium quality or artisanal ice creams will remain a niche segment. Concurrently, the fierce competition among mainstream ice cream makers amid rising inflation will stifle overall value sales over the forecast period.”

Click HERE to subscribe to our FREE Weekly Newsletter